Stabilized assets in top locations

- Focus on attractive and stabilized real estate investments in prime locations.

- No significant capex expenditures needed in the coming years.

- Investments focus on: office, retail, restaurants, food retailing, residential and hotels.

- Properties with unique selling points.

- Investments in prime locations in the TOP 30 cities in Germany with positive socio-economic development and growth expectations.

Diversified and balanced real estate investments

- Large properties with a dominating position within their market

- Strong, expanding retail brands and retail tenants with good credit ratings.

- A good mix of tenants and diversification of uses in each investment.

- Property investments are based on detailed market and tenant analyses.

- Multi-let and good third-party use as well as high potential of re-letting opportunities are key investment criteria.

Low beta investment strategy

- Stable rental cash-flows with a low risk profile.

- Investment focus on regionally dominant retail properties with high centrality, high visibility and awareness levels in its market and a good customer acceptance.

- Strong catchment areas (centrality) with high purchasing power are a guarantee for stable, sustainable yields.

- Limited investments in project developments and refurbishments.

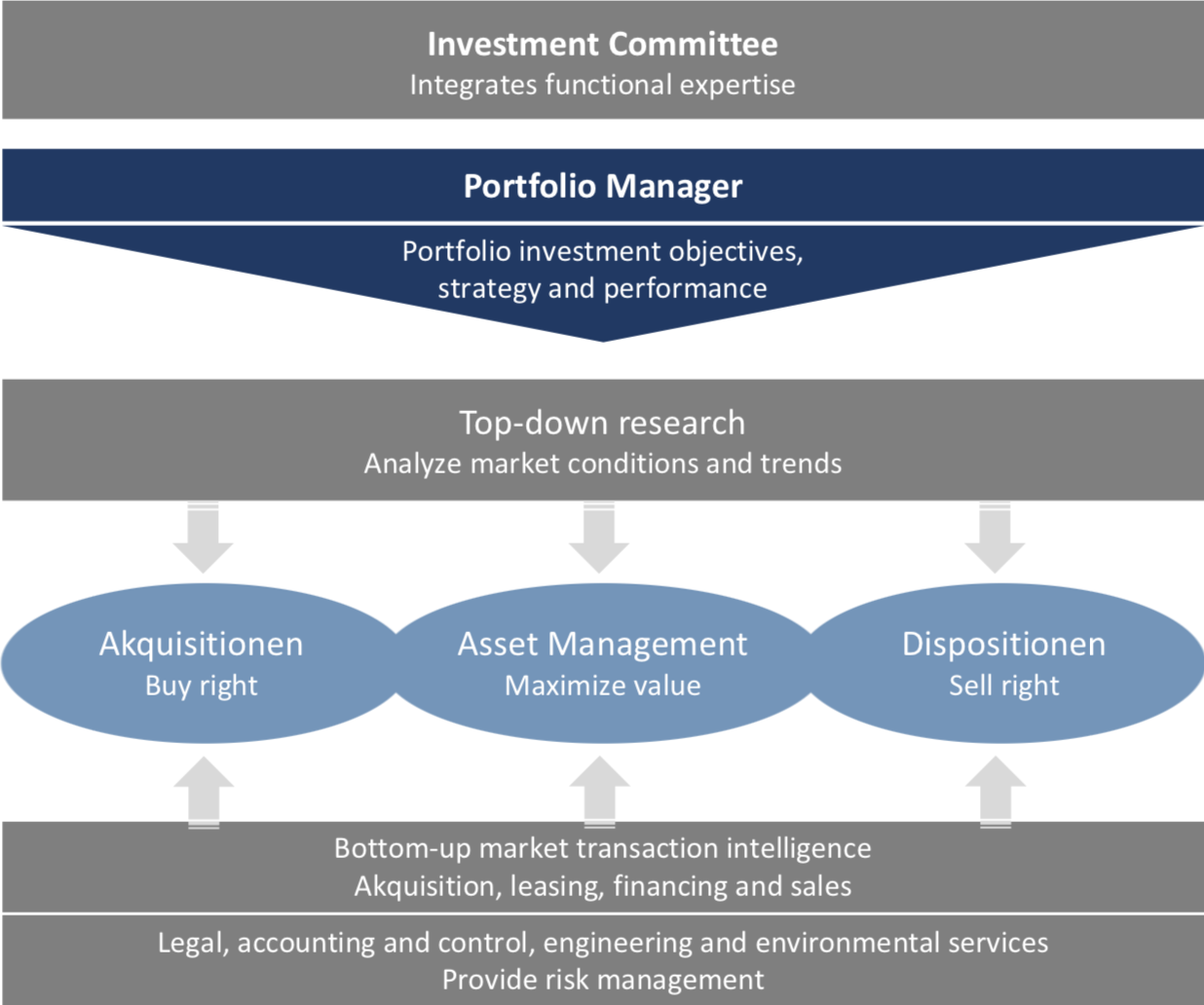

Investment decisions are based on a standardized and research-based investment process

- Chairman of the Investment Committee is a recognized, independent real estate expert.

- Equity investors can name 3 out of 5 members on the Investment Committee.

- Corporate governance, risk management, legal and tax regulations, sustainability aspects are indispensable framework conditions that are ensured in the interests of our investors.

- Portfolio Manager is responsible for the investment strategy and fund performance.

- Quarterly and standardized investor reporting’s to keep the investors informed about the fund performance, e.g.

- The research analyzes are carried out in a standardized process involving the Jones Lang Lasalle Dynamic Real Estate Analysis Monitor ("DREAM").